Halma

Halma is a cash generative and highly profitable group which develops, makes, and markets products that are used to protect lives, or improve the quality of life, for individuals and businesses worldwide.

Halma's four specialist business sectors are:

The latest Halma plc share price (HLMA). View recent trades and share price information for Halma plc and other shares. Halma Plc is a holding company which engages in the development, production and sale of hazard and life protection products. It operates through the following segments: Process Safety. Halma (OTCPK:HLMAF) is a durable business with strong free cash flow generation, minimal leverage, low capital intensity and a relatively durable business in any economic environment.

- Process Safety

Products which protect assets and people at work. Specialized interlocks which safely control critical processes. Instruments which detect flammable and hazardous gases. Explosion protection and corrosion monitoring products. - Infrastructure Safety

Products which detect hazards to protect assets and people in public spaces and commercial buildings. Fire and smoke detectors, fire detection systems, security sensors and audible/visual warning devices. Sensors used on automatic doors and elevators in buildings and transportation. - Medical

Products used to improve personal and public health. Devices used to assess eye health, assist with eye surgery and primary care applications. Fluidic components such as pumps, probes, valves and connectors used by medical diagnostic OEMs. - Environmental & Analysis

Products and technologies for analysis in safety, life sciences and environmental markets. Market-leading opto-electronic technology and gas conditioning products. Products to monitor water networks, UV technology for disinfecting water, and water quality testing products.

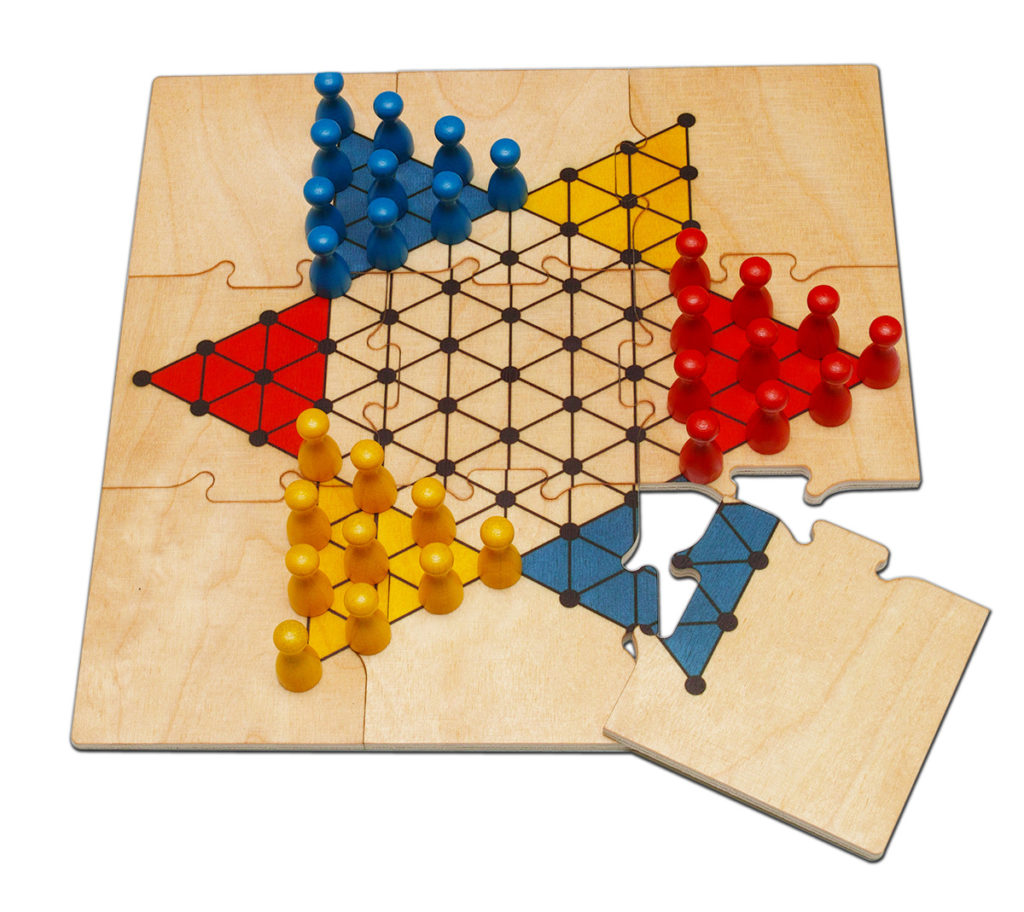

Halma Game Board

Halma's value creation strategy is to create shareholder value based on five principles:

Halma Plc Stock Price

- Operate in specialized global markets offering long-term growth underpinned by robust growth drivers.

- Build businesses which lead specialized global markets through innovative products differentiated on performance and quality rather than price alone.

- Recruit and develop top quality boards to lead our businesses and nurture an entrepreneurial culture within a framework of rigorous financial discipline.

- Acquire companies and intellectual assets that extend our existing activities, enhance our entrepreneurial culture, fit into our decentralized operating structure and meet our demanding financial performance expectations.

- Achieve a high return on capital employed to generate cash efficiently and to fund organic growth, closely targeted acquisitions, and sustained dividend growth.

Halma Group UK Head Office

Halma p.l.c

Misbourne Court

Rectory Way

Amersham

Bucks HP7 0DE

UK

Tel: +44 (0)1494 721111

Fax: +44 (0)1494 728032

Email:halma@halma.com